General Election – November 5, 2024

| Description of Event | Deadline* | E-Date1 |

|---|---|---|

| US President: Nomination Paper Period for Independent Presidential Elector Candidates | April 26 – August 9, 2024 | E‐193 – E‐88 |

| Last day for propositions to qualify to appear on the ballot | June 27, 2024 | E‐131 |

| Voter Information Guide: Proposition Ballot Title and Summary and Condensed Ballot Title and Summary Deadline | July 5, 2024 | E‐123 |

| Voter Information Guide: Proposition Argument Submission Deadline | July 9, 2024 | E‐119 |

| Voter Information Guide: Proposition Argument Selection and Exchange | July 14, 2024** | E‐114 |

| Voter Information Guide: U.S. Senate Office Candidate Statement Deadline | July 17, 2024 | E‐111 |

| Voter Information Guide: Proposition Analysis and Text Deadline | July 18, 2024 | E‐110 |

| Voter Information Guide: Rebuttal Argument and Summary Information Deadline | July 18, 2024 | E‐110 |

| Voter Information Guide: Available for Public Display and Examination | July 23 – August 12, 2024 | E‐105 – E‐85 |

| Voter‐Nominated Office: Change of Candidate’s Ballot Designation on the Ballot Deadline | July 30, 2024 | E‐98 |

| Randomized alphabet drawing for the order of the candidates on the ballot | August 15, 2024 | E‐82 |

| Notice to Candidates (Presidential and Voter‐Nominated Candidates) | August 24, 2024** | E‐73 |

| Certified List of Candidates for the November 5, 2024, Election will be posted | August 29, 2024 | E‐68 |

| Voters can check their status at My Voter Status to confirm their mailing address and voting status | August 29, 2024 | E‐68 |

| Voter Information Guide: Online Version Available | September 6, 2024 | E‐60 |

| Secretary of State will mail the Voter Information Guide during this period | September 26 – October 15, 2024 | E‐40 – E‐21 |

| County elections officials will mail the County Voter Information Guide during this period | September 26 – October 15, 2024 | E‐40 – E‐21 |

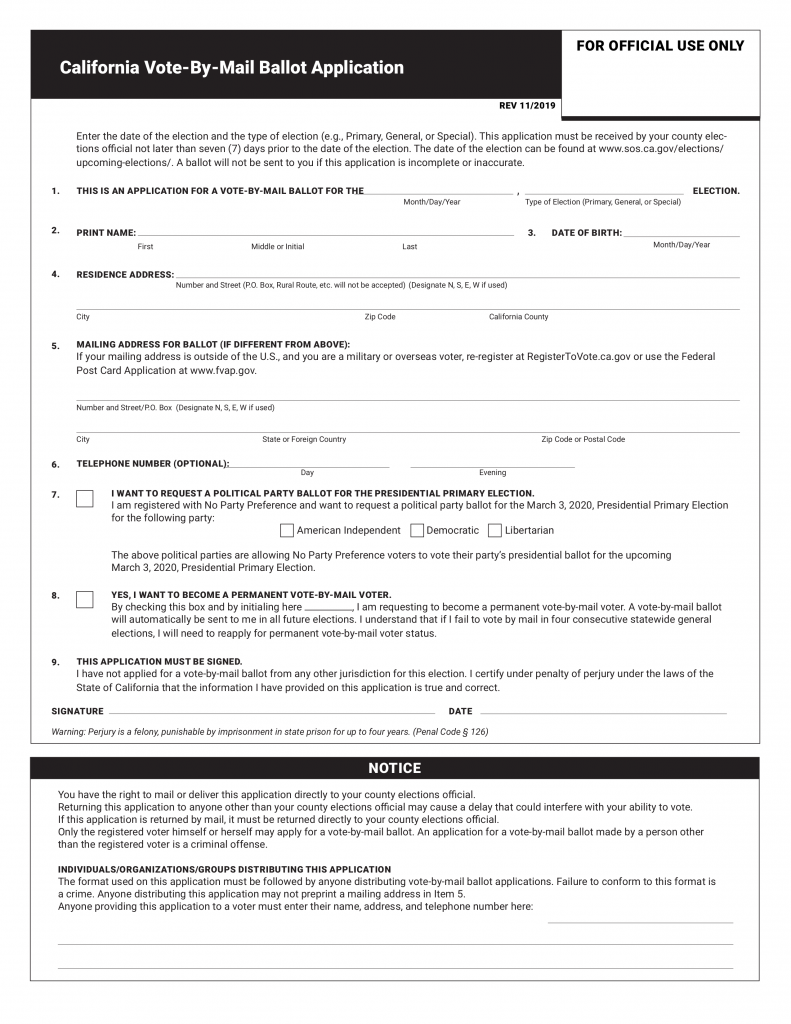

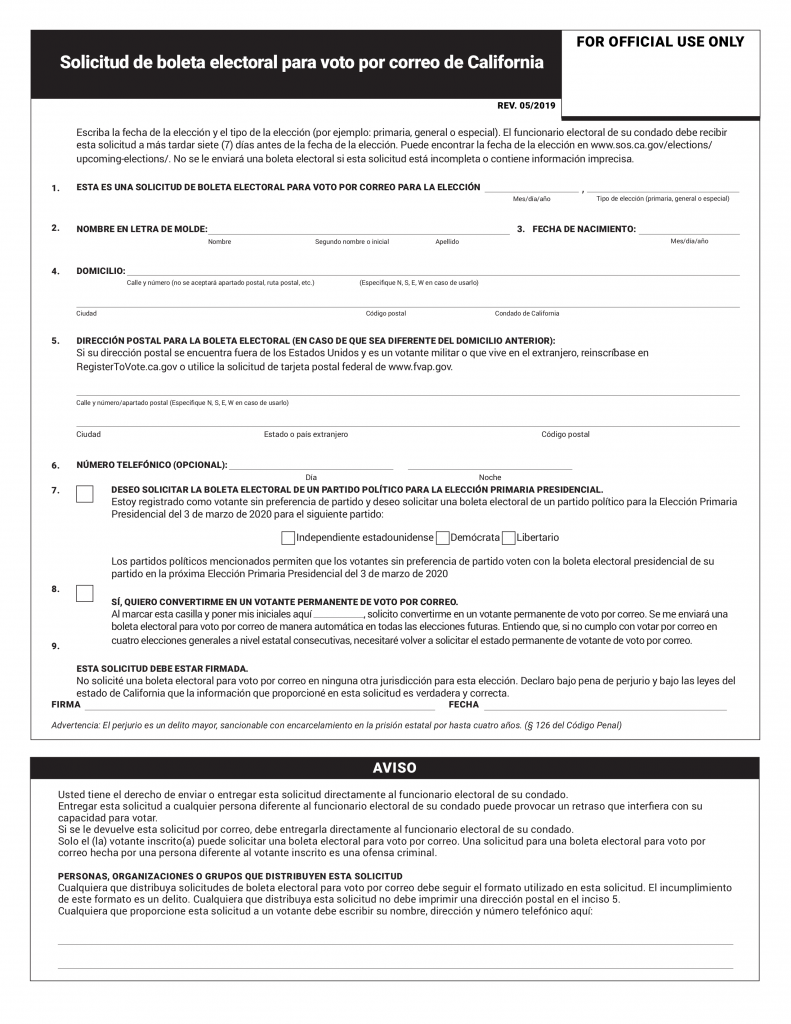

| No later than this date, county elections officials shall begin mailing each registered voter a vote‐by‐mail ballot | October 7, 2024 | E‐29 |

| Early Voting sites open | October 7, 2024 | E‐29 |

| By this date, all counties shall open ballot drop‐off locations for vote‐by‐mail ballots. To find a location, please visit: https://caearlyvoting.sos.ca.gov/ | October 8 – November 5, 2024 | E‐28 – E |

| Last day to register to vote for the general election. To check your voter registration status, visit My Voter Status | October 21, 2024 | E‐15 |

| US President: Write‐In Candidate Deadline | October 22, 2024 | E‐14 |

| Same Day Registration available. Voters can “conditionally” register and vote a provisional ballot during this time | October 22 – November 5, 2024 | E‐14 – E |

| US President: Certified List of Write‐In Candidates | October 25, 2024 | E‐11 |

| Voter’s Choice Act counties to open Vote Centers | October 26, 2024 | E‐10 |

| Election Day – Polls shall be open throughout the state from 7:00 a.m. to 8:00 p.m. | November 5, 2024 | E |

| Beginning at 8:00 p.m., county elections officials begin reporting election results; counties shall conduct the semifinal official canvass of votes and report totals to the Secretary of State at least every two hours until completed. | November 5, 2024 | E |

| Vote‐By‐Mail Ballots returned by mail, in order to be counted, must be postmarked on or before Election Day and received by your county elections office | November 12, 2024 | E+7 |

| US President: Counties to send Statement of Results to Secretary of State | December 3, 2024 | E+28 |

| Last day for county elections officials to certify election results | December 5, 2024 | E+30 |

| County elections official shall send to the Secretary of State, in an electronic format, one complete copy of the general election returns | December 6, 2024 | E+31 |

| US President: Last day for Secretary of State to analyze votes given for presidential electors and certify to the Governor the names of the proper number of persons having the highest number of votes | December 7, 2024** | E+32 |

| Statement of Vote certified by the Secretary of State | December 13, 2024 | E+38 |

| US President: Electoral College convenes | December 16, 2024 | E+41 [2:00 p.m.] |

| Last day for Secretary of State to release the official Supplement to the Statement of the Vote | April 12, 2025** | E+158 |

- *Date falls on a weekend or state holiday; it moves forward to the next business day.

- **Date falls on a weekend or state holiday; it does not move forward to the next business day.

- 1. “E-” days indicate the number of days prior to Election Day. “E+” days indicate the number of days after Election Day.↑